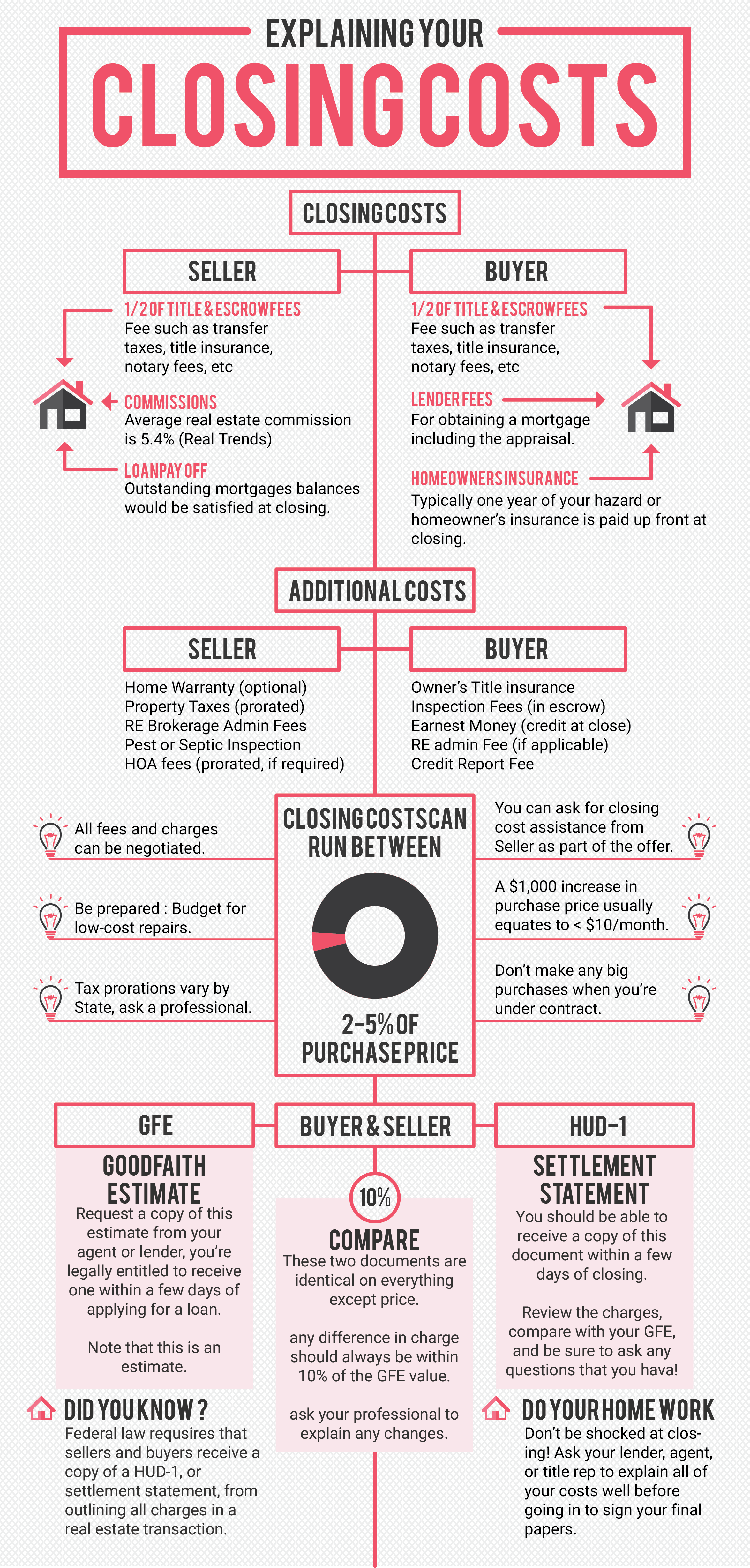

This is a question both buyer and seller ask themselves, once the sale of a house is in its final stage. We are talking about the fees that have to be paid to the third parties for their help in facilitating the sale of a home. As you might have expected these fees can vary a lot depending on the location of a house you’re buying or selling. There are no rules, but you can expect for these closing costs to be anywhere between 2% and 7% of the house’s total purchase price.

Both buyer and seller had to participate in covering the closing costs.

However, a buyer will have to pay from 3% to 5% of the total home’s price. That’s considerably more compared to seller’s one up to 3%. Either way, the closing costs have to be covered before the house is sold officially. Very often, buyers and sellers decide to pay for these closing costs when the keys to a new home have been exchanged.

Let’s first make a list of all the covering costs a buyer has to pay for:

- A fee you have to pay to the lenders for processing all the paperwork associated with your loan.

- An underwriter’s fee that’s required for assessing your credit-worthiness.

- An appraisal fee that’s supposed to make sure that the home’s value matches the loan’s amount you want in the first place.

- A home inspection’s fee you pay to check the new home for any potential issues, such as leaking plumbs or damaged roof.

- A title search fee that gives you a peace of mind by making sure that aren’t any liens associated with the property that could challenge the rightful ownership.

- A survey fee, which you have to pay only if you’re planning to buy a single-family house rather than a condo.

- The stamp taxes you have to pay the borrowed money for a home loan.

- A credit report’s fee.

When it comes to the closing costs a seller is responsible for, they usually include the following:

- A closing fee, a seller pays to the attorney’s office or the title company where the meeting for closing on the new house purchase takes place.

- Home sale taxes.

- An attorney’s fee, if a seller has hired one.

- A fee that is required for transferring the title of the new ownership.

At first glance, when compared to the total purchasing price you have to pay or get for buying or selling a house, these closing costs don’t seem much. However, these small percentages can be associated with the significant amounts you have to pay eventually. When a home is valued hundreds of thousands of dollars, then it’s not all the same whether or not you will pay 2% or 4% for the closing costs. Also, don’t forget that a seller usually has to cover the real estate commissions and costs, somewhere between 4% and 8% of the total home’s price.

List your for sale by owner

Comments are closed.